ITR F&O Trading

- Get a Qualified Tax Expert to do your taxes.

- For Individuals having Salary Income, Rental Income, Capital Gain, FNO Income and Income from Interest and Dividends.

- 100% digital and hassle-free.

- After service support available.

₹3,500

Or

Have queries? Talk to an expert

What is included in our package

Advantages of ITR F&O Trading

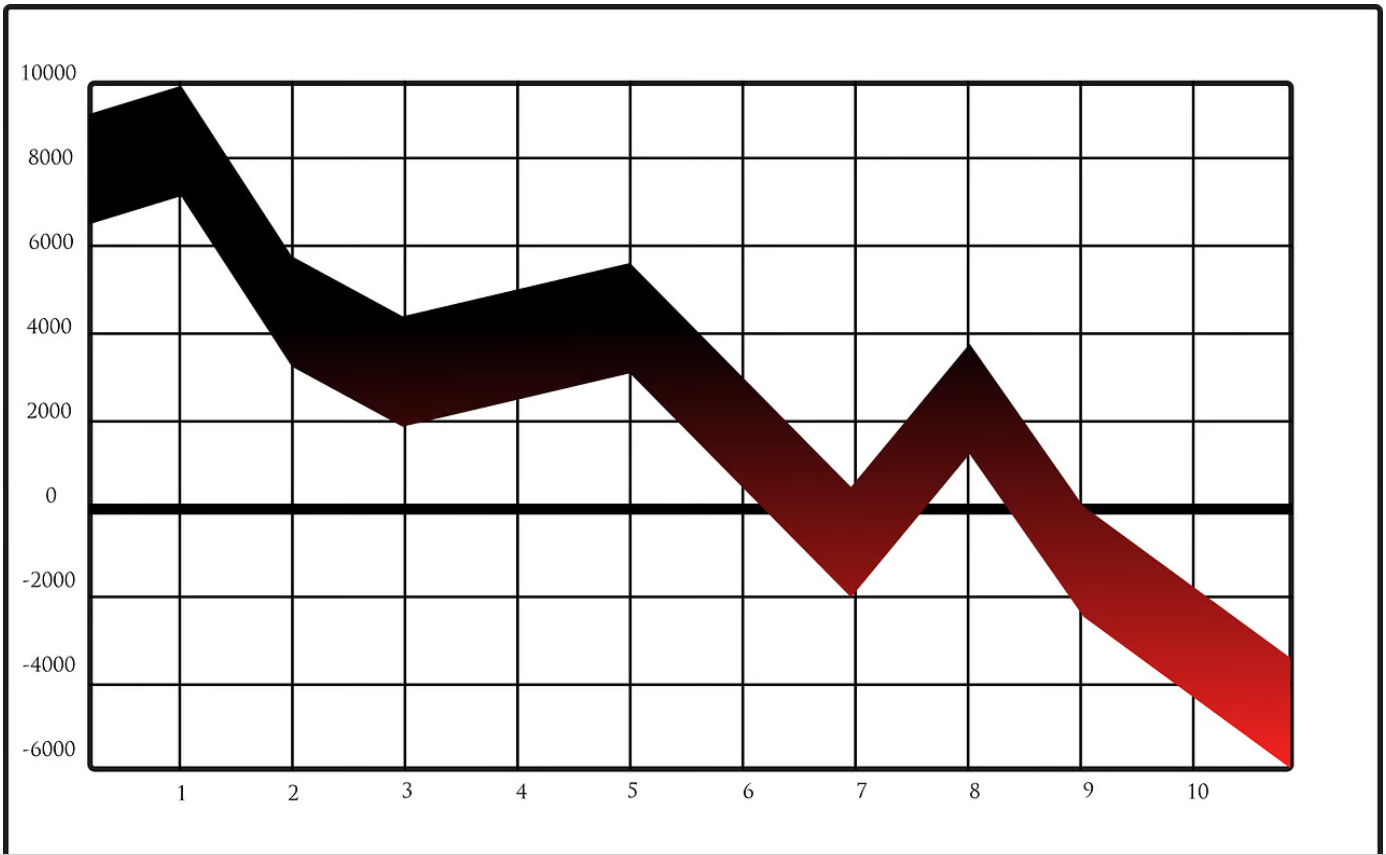

Carry Forward of Losses

Carry forward of losses in income tax returns reduces taxable income, offsets future profits, lowers tax liability, provides flexibility to recover losses, and promotes business continuity.

Define financial worth

The investors and institutions look forward for returns filed to know the capacity of the business

Loan Processing

Filing tax returns on time can help establish a good financial record, improving your chances of availing loans easily and quickly. Timely tax filing demonstrates financial responsibility and stability.

Claim Refund

Consult with our qualified tax professional to ensure you are taking advantage of all available deductions, credits, and strategies to optimize your taxes and potentially receive refunds.

Get you Visa and Immigration Done Hassle Free

Filing tax returns on time can positively impact your visa and immigration process, demonstrating financial responsibility and compliance with regulations, potentially leading to a smoother and hassle-free experience.

Documents To Be Submitted

Form 16 (Taxpayers having salary income)

Bank Statements

Details of investments

Details of insurance and loans (optional)

F&O Trading Statement

PAN Copy (optional)

Aadhar copy (optional)

How it Works

1. Get expert advice

Expert will be assigned and will connect with you to understand your taxes.

2. Document Submission

We will send a list of documents required in order to prepare your taxes.

3. Return Preparation

Expert will prepare your taxes, will review with you and finalize it.

4. Return Filing

Your ITR will be filed and all the documents will be sent to you.

5. After Return Service

We are here to help you in case of post filing notice by the IT department due to our mistake.

Income Tax Return Types applicable to different individuals

- ITR - 1 (Sahaj) - For indivickials earning income from salaries. one house property. interest income, agriculture, other sources. etc.

- ITR - 2 - For Indivicuals and HUF having income other than from profits and gains of business or profession. It may be from capital gain, lottery or foreign assets. atc.

- ITR - 3 - For individuals and HUF with income from profits of a business or profession.

- ITR - 4 (Sugam) - For Individuals, HUFs and Firms (other than LLP having presumptive business income tax returns This is computed under sections 44AD. 44ADA Of 44AE.

- ITR - 5 - Entitios other than. - ® individual.) HUF. i) company and (iv) person filing Form ITR-7 oe

- ITR - 6 - All companies except those that claim tax exemption as per Section 11

- ITR - 7 - Parsons incl. companios required to furnish raturms under sections 139(4A) or 139(4B) or 139(4C) or 139(4D) only.

Frequently Asked Questions

© 2025 Capikar Technologies. All rights reserved